open end loan examples

Open-end credit is a contrast to closed-end credit which is more commonly called an installment loan. An auto loan is an example of this.

![]()

What Types Of Loans Are There Student Loan Hero

Personal lines of credit and credit cards Fixed-rate loans.

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

. An open-ended loan is a loan that does not have a definite end date. For example if an open-end credit account ceases to be exempt A closed-end loan is exempt under 10263b unless the extension of credit is secured 22. In other words the borrower has the right to tap into the credit made available to.

As a result the total loan both the initial and the top-up will not be allowed to. An open credit is a financial arrangement between a lender and a borrower that allows the latter to access credit repeatedly up to a specific maximum limit. A loan or line of credit is unsecured when it does not require an item of value as security.

Open-end loans can also take the form of credit cards or home equity lines of credit. Open-end loans are categorized as either secured or unsecured. Federal student loans and some personal loans 35.

A common type of open-end loan is a line of credit. Secured and Unsecured Open-End Credit. For example if a customer fails to repay an auto loan the bank may seize the vehicle as compensation for the default.

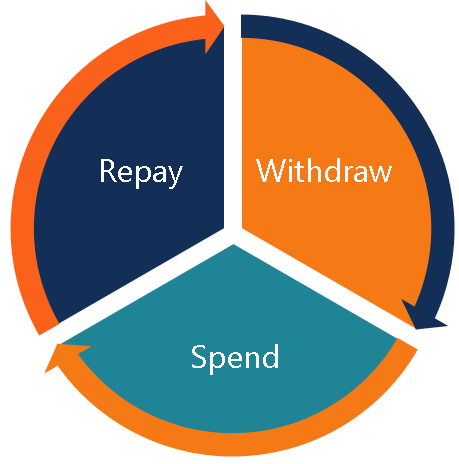

HELOCs are open ended meaning you borrow as you go instead of borrowing a set amount of funds all at once you withdraw and repay as needed. Personal lines of credit and credit cards. You use 8000 of it repay 5000 of it in the next couple of months 21.

An open-end mortgage saves the borrower the time and trouble of looking for a loan elsewhere. Banks typically establish a maximum loan-to-value ratio. Open-end credit is a revolving credit product while closed-end credit is a nonrevolving lending product.

An agreement between a financial institution and borrower whereby the borrower is similarly allowed to borrow funds up to a preapproved dollar limit. In this article well see the meaning of an open-end loan with an example. If the borrower does negotiate a modification of the loan the borrower will be subject to penalties as determined by the lender.

Lets give an example of an open-end loan. A secured credit card and home equity line. Ad Create a Loan Contract to Document a Financial Agreement Between Two Parties.

Any revolving credit product such as a credit card or personal line of. Thats the core difference between these distinct forms of credit. Fast Easy Form.

An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the borrower the freedom to use the amount of credit it needs whenever it is needed. For example most credit cards are issued to you without collateral attached to them. An open-end loan is a revolving line of credit issued by a lender or financial institution.

With open-end loans borrowers can spend money up to a pre-approved limit known as the revolving credit limit. By comparison loans for a predetermined amount such as auto loans are considered to be closed-end loans. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower.

It is available in two varieties each with unique characteristics that can benefit the borrower. Open-end loans offer you the chance to borrow as much or as little money as you want up to a certain amount and then pay back some or all of the funds monthly. Financial institutions can offer open-end credit and closed-end credit to consumers and businesses.

Its a sort of revolving credit in which the borrower can tap into the same loan up to a certain limit. Easy Do-It-Yourself Loan Agreement. This loan is for the purchase of property at a sale price of 180000 and has a loan amount of 162000 a 30-year loan term a fixed interest rate of 3875 percent and a prepayment penalty equal to 200 percent of the outstanding principal balance of the loan for the first two years after consummation of the transaction.

Ad Fill in One Simple Form Get The Best Personal Loan Offers for You. You take 10000 on an open-end loan. An open-end mortgage is a unique type of home loan in that the borrower has the opportunity to use the funds from the loan as needed even after they purchase the property.

Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due. The difference between closed-end credit and open credit is mainly in the. You or the dealership in this case receive a lump-sum payment upfront for a certain amount that you then repay with interest over a set term in fixed installments.

Like a traditional mortgage loan it gives the borrower enough cash to purchase a home. Get Low-Interest Personal Loans Up to 50000. Examples of open-ended loans include lines of credit and credit cards.

Open-End Loan Real Estate Agent Directory. Membership or Participation Fees. Specifically the borrower cannot change the number or amount of installments the maturity date and the credit terms.

If the plan provides for a variable rate that fact must be disclosed. Any periodic rate that may be applied expressed as an annual percentage rate using that term or the abbreviation APR. Examples of an Open-End Loan.

Create Legal Documents Using Our Clear Step-By-Step Process. In the consumer market home equity loans are an example of an open-end credit which allows homeowners to access funds based on the level of equity in the homes. Ad Get Your Loan Agreement Today.

Definition and Examples of an Open-End Mortgage. Say you take out an auto loan. Triggered Terms 102616 b.

A secured open-end loan is a line of credit thats secured by or attached to a piece of collateral. If they carry over a balance on their credit card or loan from.

Revolving Credit Vs Line Of Credit What S The Difference

Lesson 16 2 Types Sources Of Credit Ppt Download

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

25 Powerful Open Ended Questions To Boost Sales Business 2 Community

Truth In Lending Act Tila Consumer Rights Protections

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

What Are Open Ended Close Ended Questions Definition Examples Writing Explained

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

Essential Standard 5 00 Objective Ppt Download

Types Of Auto Loans Know Your Car Loan Options Lendingtree

Types Of Credit Definitions Examples Questions

![]()

What Types Of Loans Are There Student Loan Hero

What Is Open End Credit Experian

Consumer Loan Overview Types And Categories

Chapter Open Ended Credit An Agreement To Lend The Borrower An Amount Up To A Stated Limit And To Allow Borrowing Up To That Limit Again Whenever Ppt Download

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)